Everyone is thrilled - investors, the founders, and other startups. Zomato's accomplishment of making a profit this quickly has everyone praising the company. Even Zomato's own team had predicted that profits would be at least three quarters away, making it a delightful surprise.

But you may wonder, how did Zomato manage to achieve this feat?

Well, it's not overly complicated. As mentioned by Deepinder Goyal, Zomato's CEO, the company simply had to focus on two things - "increasing profits in food delivery and reducing losses in the quick commerce (Blinkit) business."

Let's delve into how food delivery is performing, as it remains Zomato's core strength.

In this business, there are three key metrics to consider.

Firstly, the Gross Order Value (GOV), which is determined by the total amount users spend on food orders. This figure has experienced an 11% increase compared to the previous quarter. While some of it could be attributed to seasonality, such as school holidays, IPL, and other summer events during the first quarter of the financial year, it is worth noting that GOV remained stagnant at around ₹6,500 crores throughout the entire last year. Hence, it appears that things are looking more promising this year.

Does this imply an increase in the number of users who now utilize the platform to order food?

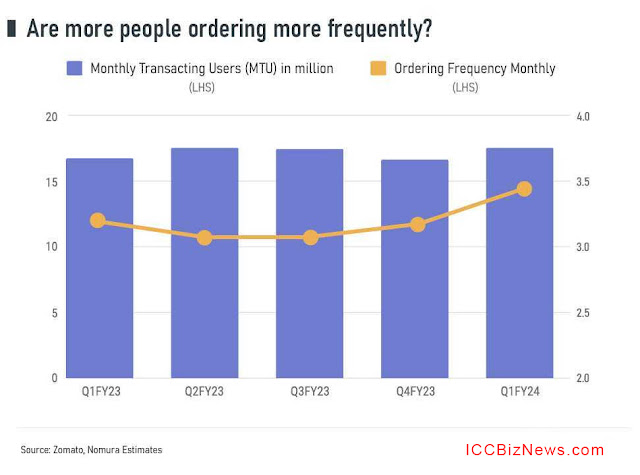

That's precisely why we examine a metric known as Monthly Transacting Users (MTU).

Currently, there are approximately 17.5 million people using the platform on a monthly basis. However, what's surprising is that this number hasn't shown significant growth. Remarkably, nine months ago, Zomato already had 17.5 million monthly transacting users, indicating that they haven't been successful in attracting more users to make transactions on the platform. This development raises some concerns, leading investors to question whether the food delivery business has already reached its saturation point in terms of easy gains.

What do we mean by this?

Initially, the penetration levels of online food delivery may appear relatively low, hovering around 15-16%. One could argue that there is still a substantial untapped market to capture.

However, let's draw a parallel with e-commerce for a moment. Some time ago, we delved into a report by venture capital firm Blume Ventures, which revealed that 19% of India's households engage in online shopping. Interestingly, this percentage is similar to that of food delivery, isn't it?

Upon closer examination, one would notice that within the high-income category (earning more than ₹ 6 lakhs), e-commerce penetration has already reached an impressive 37%, indicating significant uptake in this segment.

While we lack a comparable breakdown for food delivery, it is plausible that a similar scenario exists. Perhaps, this is why Zomato made the decision to scale back its city portfolio, as evidenced by its exit from 225 cities in January of this year. The business prospects in those cities were not up to par.

Given that urban areas may already be saturated, Zomato's focus now lies in finding ways to increase revenue from its existing user base.

This brings us to the Average Order Value (AOV), a critical metric to monitor since the company incurs nearly the same delivery costs for both a ₹ 200 order and a ₹ 400 order. However, higher order values translate to higher commissions earned.

Regrettably, Zomato didn't provide a detailed breakdown of the AOV for food delivery, but it did mention a 'modest uptick.' In FY23, the AOV stood at around ₹ 407, implying that it may have increased slightly since then.

However, investment research firm Nomura has also assessed another aspect - the frequency of Zomato's users placing orders each month. They are exploring whether the quirky push notifications are effectively encouraging users to place more orders. According to their estimate, the frequency has increased from 3 orders a month to 3.4 orders now.

What could be the reason behind this trend?

One potential factor is Zomato Gold.

Over the years, Zomato has introduced several variations of its renowned subscription service. There was Gold, then Pro, and now Gold again. Zomato relaunched Gold in January this year, and here are the features they described for it.

Zomato Gold's key highlight is its 'On-Time Guarantee,' a feature that took three years to develop, showcasing a significant achievement for the team. Gold members enjoy various benefits, including priority access to more restaurants during peak hours, exclusive offers from several restaurants for both delivery and dining-out, and access to intercity delivery from legendary restaurants known as Intercity Legends. Additionally, Gold members receive free delivery on orders that meet specific criteria. Within a short span of time, the Zomato Gold program has attracted over 900,000 members.

As we approach Q1FY24 (April-June), it marks the first full quarter of the revamped Zomato Gold program. Remarkably, orders from Gold subscribers already contribute 30% of the Gross Order Value (GOV) in food delivery. If Zomato's intuition is correct, this time, they seem to have struck gold, quite literally.

Taking all these factors into consideration, it becomes apparent that the food delivery business has been consistently generating profits in the background, despite not experiencing extraordinary growth.

The troublesome venture was Blinkit, a quick-commerce, loss-making delivery player that Zomato acquired in June 2022. The news of this acquisition left investors dissatisfied, leading to a quick 30% decline in the stock value.

However, it appears that things are finally taking a positive turn in this area as well.

The Gross Order Value (GOV) has doubled from ₹ 1,000 crores to ₹ 2,000 crores over the past year. The Average Order Value (AOV) has gradually increased to ₹ 582. Moreover, the so-called 'contribution,' which represents the profit earned by the company on each delivery after accounting for the delivery costs and other processing fees, has experienced a significant decline. When calculated as a percentage of the GOV, it has now become nearly positive.

Perhaps a portion of the improvement can be attributed to Blinkit's implementation of cost-cutting measures, particularly in reducing the payouts to delivery riders. According to a Medianama report from a few months back, the cuts were quite substantial:

Irfan (alias), a former Blinkit delivery executive who was previously associated with the company when it was called Grofers, stated that he used to earn Rs 50 per order. When the company transitioned to Blinkit, the earnings dropped to an average of Rs 25 per order. Now, under Zomato's leadership, the earnings have further decreased to an average of Rs 15 per order.

Even Albinder, the CEO of Blinkit, acknowledged that they experienced a temporary business disruption in April due to the change in the delivery partner payout structure. While this may not be well-received by gig workers, it could certainly please shareholders.

With only 4 million households as Monthly Transacting Users (MTUs) on Blinkit currently (compared to Zomato's 17.5 million), the potential for growth is much more significant. Interestingly, Deepinder Goyal believes that Blinkit's growth may become even more critical to Zomato's shareholders than its food delivery business in the next 10 years. That's certainly an intriguing bet.

Considering everything, it does seem like Zomato is putting on a good show, doesn't it?

However, we do have one little secret to share: despite all the positive developments, Zomato still incurred a loss of ₹ 15 crores.

Yes, a loss!

Now you may wonder about the ₹ 2 crores profit that everyone is talking about. So, what's the story behind it, you ask?

As highlighted by Moneycontrol, there was a tax provision that surfaced, specifically a line item called "deferred tax" amounting to ₹17 crores. Once this adjustment was factored in, Zomato ended up with a profit of ₹2 crores.

To understand deferred tax better, consider it as a scenario where Zomato might have paid taxes in the past, but now they are allowed to offset the tax amount against the losses they incurred. It's a standard accounting practice.

Although the exact reasons for Zomato's deferred tax windfall remain unknown, it's worth noting that this is not a new occurrence in the food delivery company's financial records. They have been claiming deferred taxes for a few quarters now.

The million-dollar question is: can Zomato maintain its profits if they were primarily driven by a tax gain?

Well, it's quite likely.

Let's set aside the impact of deferred tax for a moment and focus on the overall loss itself. In the previous couple of quarters, the loss amounted to nearly ₹200 crores. However, it has now significantly narrowed down to the ₹15 crores we see currently. Moreover, with Zomato's ongoing efforts to further reduce costs, the outlook appears positive.

As the story unfolds, we will have to wait and see how things pan out, won't we?

Until then, good luck, Zomato. Everyone is cheering for your success.