Government is working on ways to bring down debt, Finance Minister Nirmala Sitharaman said on Friday.

According to Moody’s Investor Services, India has a relatively high level of general government debt, estimated at around 81.8 per cent of GDP for 2022-23, compared with the ‘Baa’-rated median of around 56 per cent.

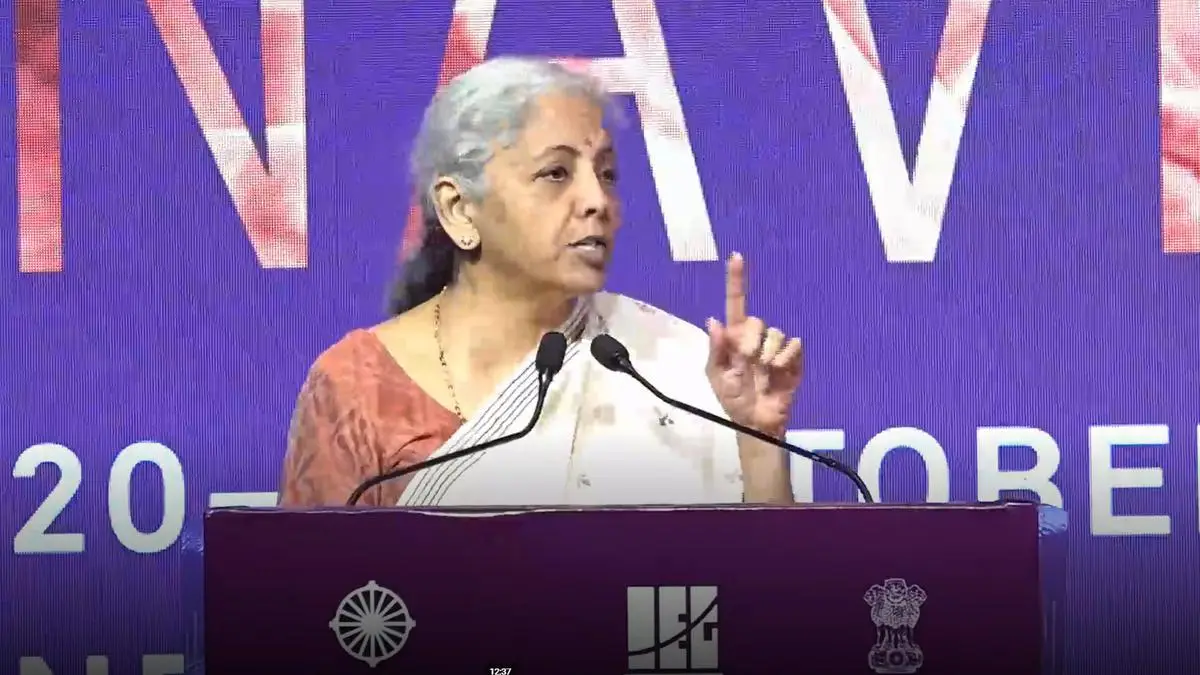

“The government is conscious of the debt burden. Our efforts are very well streamlined and I am sure we will be able to bring it down. Need to be sure that the money spent is well used. Bang for the buck is well in our minds,” Sitharaman said, while addressing the Kautilya Economic Conclave.

She said the government is analysing how other economies are taking steps. “Some of the data about some emerging market countries, about how they are managing their debt, is something which is actively on our minds in the Ministry (of finance) and we are looking at ways in which we can bring down the overall debt. And, we are I am sure, going to be very successful in that,” she added.

PMJDY

Highlighting the digital infrastructure, she mentioned the PM Jan Dhan Yojana. When the scheme was launched, a certain section of people had made “snide” remarks saying public sector banks would be under pressure, as these are zero balance accounts. However, these accounts have a balance of more than Rs 2 lakh crore, she added.

“Benefits under more than 50 government schemes are directly transferred into the beneficiaries’ bank accounts, and PMJDY has played an important role,” the Minister said.

Crypto Regulation

Cryptocurrency is not something where any one country can succeed, the Finance Minister noted in her remarks. She added that the matter was taken up at the recently concluded G20 group for consensus on whether crypto should be regulated, and if so, how. “The G20 is now coming out with a template for the crypto world, she added.

Concerns about Multilateral Institutions

FM Sitharaman expressed concerns about the inadequacy of major multilateral institutions, including the United Nations, the World Health Organisation, the World Trade Organisation, and the UNSC. “Interventions by these organisations, other than multilateral development banks, are currently less effective than ideal, especially since they were first instituted. This decline in effectiveness is reshaping strategic blocks across the world, impacting supply chains, and has far-reaching consequences,” she said, while adding the world has not yet recovered from Covid.

Food security

India is working on establishing a template to maintain food security, she said. “There should be a regional balance for basic staples for sufficiency and security,” she said. This effort goes beyond India‘s borders, as the Finance Minister highlighted the importance of regional balance for basic staples, to ensure food sufficiency and security, particularly in the context of global uncertainties.

Global terrorism posing risk for businesses

Sitharaman also touched upon the pressing concern of global terrorism, acknowledging that it has become a “permanent uncertainty” with a high-cost risk associated with it. This serves as a primary risk for businesses worldwide, and economic policies alone are insufficient to address it. Companies need to factor in the impact of terrorism on their operations and strategies, she said.

.jpg)