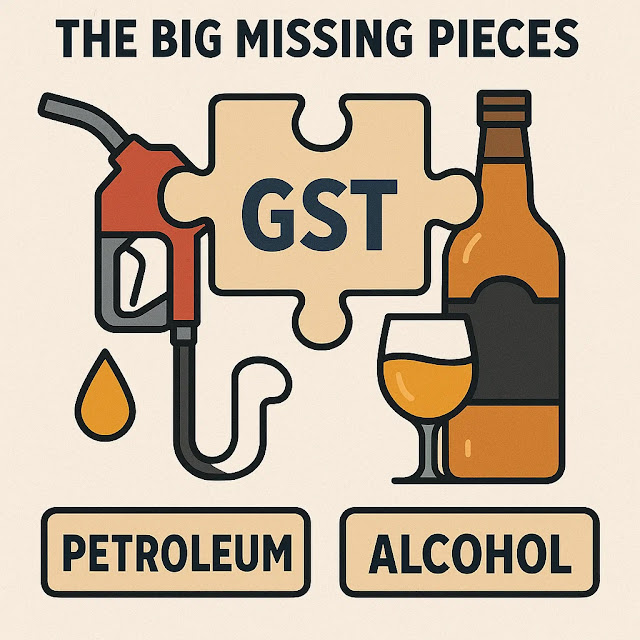

Synopsis : Eight years into India's GST journey, petroleum and alcohol remain outside its scope, fragmenting the indirect tax system. While the Centre has hinted at gradual inclusion of petroleum, alcohol continues to face political roadblocks.

The Goods and Services Tax (GST), implemented on 1 July 2017, was hailed as India's biggest indirect tax reform to unify a fragmented tax system and simplify compliance for businesses and consumers. Eight years later, the exclusion of two key revenue-generating sectors—petroleum products and alcohol—remains a significant challenge to the dream of a seamless, comprehensive tax regime.

Why are they excluded?

Constitutional provisions like Article 366(12A) keep alcohol out of GST, while Entry 54 of the State List allows states to levy VAT on petroleum products. For states, alcohol and petroleum taxes contribute 25–30% of their revenues, making inclusion under GST politically and fiscally sensitive. Concerns include loss of financial autonomy, volatility in revenue due to global crude price fluctuations, and the political sensitivity of alcohol taxation.

Impact of Exclusion:

The continued exclusion creates a fragmented tax structure, complicates compliance for businesses, and leads to cascading taxes since input tax credit cannot be claimed on these sectors. Airlines, transport companies, and industries using petroleum-based inputs continue to bear higher operational costs due to this structural inefficiency.

What lies ahead?

Policy experts suggest a phased approach, beginning with the inclusion of natural gas and ATF under GST, supported by a revenue-neutral rate and a compensation mechanism for states to offset revenue losses during the transition. For alcohol, constitutional amendments and a flexible GST slab with state-level surcharges could be explored to balance control and compliance. Building political consensus within the GST Council will be crucial for long-term benefits such as reduced tax cascading, lower compliance complexity, and enhanced ease of doing business in India.

While the Centre has expressed interest in gradually including petroleum under GST, a clear timeline is yet to be announced, and the debate over alcohol remains politically contentious. As India marks eight years of GST, addressing these gaps will determine the reform’s maturity in building a truly unified tax system in the coming years.

Disclaimer : This article is for informational purposes only and does not constitute tax, legal, or financial advice. Readers should consult professionals for advice specific to their situation.

.jpg)