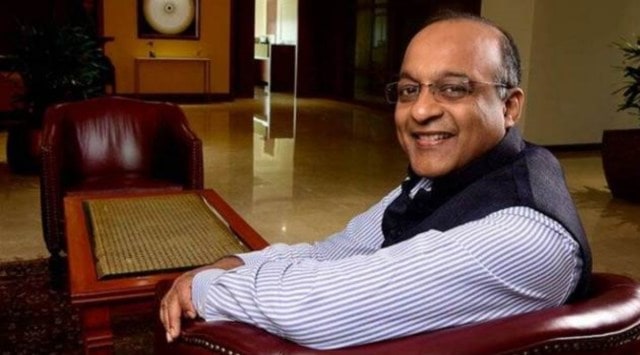

HDFC Bank Managing Director and CEO Sashidhar Jagdishan on Saturday said post-merger the lender is aiming to grow at a far accelerated pace which could create ‘a new HDFC Bank every 4 years’.

In his first address after the merger of HDFC Ltd and HDFC bank, Sashidhar said the lender will be adding over 1,500 branches annually for some years to increase its reach to several parts of the country. The merger of both the entities came into effect from July 1.

“The runway for financial services and mortgage, which are so underserved and under penetrated, is going to be very large. HDFC Bank – the combined entity – with a large and growing distribution and customer franchise, more than adequate capital, a healthy asset quality and profitability, will be best positioned to capture growth. The pace at which we aim to grow – we could be creating a new HDFC Bank every 4 years!” said Sashidhar.

According to him, the decision for the merger was spurred by the right timing, both, from an ‘economics’ and a regulatory perspective. The bank wants to harness the bond which the erstwhile HDFC Ltd created with customers through its over four decades of operations, he said.

Sashidhar said the penetration levels of the home loan product in the bank’s customer base is quite low and merger gives an opportunity to improve it.

“The Bank with its superior digital platform and digital journeys will have the propensity to upsell to the home loan customer with a complete bouquet of the Bank’s and subsidiaries products across pay, save, borrow, invest, insure, and trade,” he noted.

While welcoming over 4,000 employees of HDFC Ltd who have joined the bank, he assured them that their job and pay will be protected. “To ensure there is fairness, we elected an independent external expert to arrive at a formulae. A committee of seniors from Ltd. and the Bank reviewed the expert’s work and did a management overlay wherever corrections were needed,” he noted.

Allaying concerns of HDFC Ltd employees regarding fair treatment, he said the bank will be setting up a grievance committee to address any concerns.

“We commit that once you settle into your roles, the committee will examine any further corrections to levels,” he said.

Mistry, Karnad to join HDFC Bank board, Rangan to be ED

As part of the merger plan of HDFC Ltd and HDFC Bank, two top directors of the mortgage major have joined the board of HDFC Bank. Keki M. Mistry and Renu Karnad have joined the merged entity as additional Non-Executive (non-independent) Directors of the bank. Their appointments will be with effect from June 30 and liable to retire by rotation. Mistry was earlier Vice-chairman and CEO of HDFC Ltd while Karnad was the Managing Director.

The board of the bank has also recommended to the Reserve Bank of India, the candidature of V. Srinivasa Rangan for appointment as an Executive Director (Whole-time Director) of the bank for a period of three years. His appointment will be effective from the date of approval by the RBI and subsequently by the shareholders of the bank.

While Atanu Chakraborty is currently the part-time Chairman of the bank, Umesh C Sarangi, Sanjiv Sachar, Sandeep Parekh, MD Ranganath, Sunitha Maheshwari and Lily Vadera are the other Directors. Renu Karnad was a Non-Executive Director. Apart from Sasidhar Jagdishan, Managing Director and CEO, Kaizad Bharucha is currently the Deputy MD and Bhavessh Zaveri is an Executive Director.

The combined entity with a market capitalisation of Rs 14.37 lakh crore (US $ 175 billion) is likely to benefit both the shareholders and customers at a time when the Indian economy is making a steady growth. The merger of both the entities came into effect from July 1.

HDFC Bank shares closed 1.51 per cent higher at Rs 1,701.75 on Friday. HDFC Ltd closed at Rs 2,821.50, higher by 1.51 per cent.

.jpg)